The Extraordinary Asymmetric Investment Opportunity of Paltalk vs. Cisco

500%+ potential 30 day return on PALT w/ downside limited by low valuation and net cash

- US Western District of Texas Case Case #: 6:21-cv-00757 re: U.S. Patent No. 6,683,858

-Paltalk’s patent infringement damages vs. Cisco could be multiple of cash adjusted market cap

--$10B+ Webex revenue stream = very large royalties even if lower rates applied

-Settlement conference Tuesday could transform Paltalk’s already strong balance sheet if company accepts settlement offer instead

If Paltalk (NASDAQ: PALT) doesn’t accept an offer of settlement from Cisco (NASDAQ: CSCO) in their patent infringement case on Tuesday, it will set up one of the most interesting asymmetric investment opportunities for a NASDAQ listed company that we have ever seen.

PALT could be a multibagger in just a few days or weeks depending upon the outcome of the Paltalk vs. Cisco Case #: 6:21-cv-00757 in the Texas Western District Court, as it will determine if Paltalk is paid a royalty on the $10 billion+ revenue that was allegedly earned by Cisco’s Webex while using the company’s patented processes. Even if a lower royalty rate on the lower end of the scale is assessed it could result in a payout to Paltalk of $100s of millions, which would be a large multiple of the company’s current cash adjusted market cap. This is rather extraordinary in many respects, but from an investor’s standpoint, we find it particularly so that a company with only 9 million shares outstanding (4 million public float) stands to potentially receive $100-$300m in lump sum royalty damages, even if damages are assessed at a lower royalty rate than the last two patent infringement enforcement actions vs. this defendant received (SRI – 3.5% and Centripetal – 5% and 10%).

The purpose of this article is not to handicap the likelihood of the different royalty ranges, rather it is to point out that the stock is priced at a level that assumes ZERO PATENT INFRINGEMENT RECOVERY despite the settlement conference tomorrow and trial March 6 in a venue that is the most favorable to a patent enforcer and in a case where Paltalk has prevailed in every material aspect of the litigation process thus far. The rulings at the claims construction (Markman) hearing, the motions for summary judgement and most importantly, the USPTO’s rejection of Cisco’s attempt to have the patent declared invalid all point to the fact that Paltalk’s chances of winning this case have improved markedly at each stage of this process.

The revenue stream that could be subject to royalties are Cisco's Webex conferencing service revenue, estimated to be about $10-$11B for the period covered in the litigation (the six years prior to Paltalk’s filing in July of 2021). The royalties that have been awarded in patent litigation with Cisco over the last two years have ranged from 3% to 10%. In the chart below we took the lower end of that revenue stream range ($10B) and applied different royalty rates to give an idea of the level of damages that could be in play here. We took the (3%,5%10%) used in Cisco’s two most recent trials and added some lower tiers (1%, 2%) to be conservative. The first row assumes base royalties awarded with no enhanced damages, the next two rows show what could happen if enhanced damages are included like they were in each of Cisco’s last two patent infringement trials.

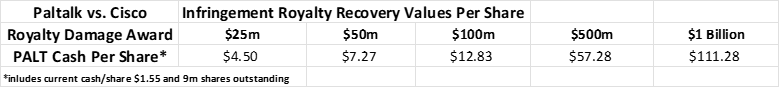

As you can see from the chart above, even a judgement that uses the lowest tier with no enhanced damages results in royalties of $100m to Paltalk. Add enhanced damages for Cisco legal defense going “over the line” as the Judge on one of their most recent patent litigation trials indicated they have done or just use one of the higher royalty rates that were used in Cisco’s two most recent trials. The numbers that could be awarded to Paltalk start at $100 million and even in the middle ranges get to the half a billion range with enhanced multipliers pushing the figures over $1 Billion. The chart below shows the cash impact each level of damage royalties would produce based on Paltalk’s 9m shares outstanding:

As can be seen in the chart above, when this process is over (25 days or less) Paltalk’s cash per share could be anywhere from $4.50 to $100+ based on a settlement in the tens of millions of dollars or a verdict that could be in the hundreds of millions or even billion+.

What happens if the case goes to trial and Paltalk doesn’t win? While I’d argue the stock price does not currently bake in any patent infringement revenue expectations, I would not be surprised to see it fall initially if the stock trades to a significantly higher level leading up to the trial’s conclusion. But that could be somewhat muted when investors realize that the company’s core business will likely report profits in each quarter going forward, as the company has been operating near to breakeven and the cessation of litigation costs each quarter plus the growth of its subscription businesses leads us to believe that PALT could be operating in the black again in Q2-Q3.

To be crystal clear, we are not saying Paltalk is going to win a billion dollars in this trial. But the reality is they absolutely could. For all of the reasons above plus the fact that David has done quite well against Goliath in this venue. The last company of Paltalk’s size (VLSI) that enforced a patent against a company of Cisco’s size (Intel) in this same courtroom won $2.2 Billion. And the last Paltalk-sized company that sued Cisco won a judgement of $2.7 Billion. So again, it would not be so extraordinary for a company of Paltalk’s size to win a billion dollar verdict against a company of Cisco’s size. What is extraordinary is that it’s a public company that investors can own a stake in. And a patent royalty recovery of 1/10 those verdicts by Paltalk makes its stock a 10 bagger on the cash alone, before you factor in the precedential value of such a ruling and how it would be used to price settlements from what appears to be other non-paying users of this patent like Zoom (NASDAQ: ZM), Google (NASDAQ: GOOG) and Facebook (NASDAQ: META).

In summary, the upside potential for a stock trading in the $3s that could realistically be awarded royalties of $5-$50 per share over the next few weeks vs. the limited downside when that company is trading at an enterprise value of $13m even though it has $15m+ in cash and no debt is one of the greatest asymmetrical investment opportunities we have ever seen for a NASDAQ listed stock.

Any speculation why the pre-trial conference was cancelled until further notice. Pending settlement, Cisco playing hardball?